Have you ever wondered how much money the average person really has? We’re diving deep into the world of net worth, and trust me, it’s not just about how much cash is in someone’s bank account. Net worth is like a financial report card that tells you where you stand in terms of assets and liabilities. So, if you’ve been scratching your head trying to figure out what’s considered “common” when it comes to net worth, you’ve come to the right place. Let’s break it down, shall we?

Understanding net worth isn’t just for financial experts or Wall Street wizards. It’s something everyone should care about because it affects your financial health and future. Think of it as the big picture of your money situation. If you’re curious about how your net worth stacks up against others, we’ve got all the answers you’re looking for.

This isn’t just another boring article about numbers and stats. We’re going to chat about what common net worth really means, why it matters, and how you can improve yours. So, grab a cup of coffee, get comfy, and let’s dive into the fascinating world of financial wellness.

Read also:Exploring The World Of Maid Cast Roles Responsibilities And Insights

What Exactly is Net Worth?

Let’s start with the basics. Net worth is the difference between what you own (assets) and what you owe (liabilities). It’s like a financial snapshot that gives you an idea of your overall financial health. Assets include things like your house, car, savings, investments, and anything else of value. Liabilities, on the other hand, are your debts—think mortgages, student loans, credit card balances, and other financial obligations.

So, to calculate your net worth, you simply subtract your liabilities from your assets. If the number is positive, congrats! You’re in a good financial position. But if it’s negative, don’t panic—it just means you have more debt than assets. The good news is, you can work on flipping that number around.

Why Does Net Worth Matter?

Net worth might sound like a fancy term, but it’s actually super important. It’s a key indicator of your financial stability and how well you’re managing your money. A strong net worth can open doors to better financial opportunities, like securing loans at lower interest rates or investing in assets that grow over time.

On the flip side, a low or negative net worth can be a red flag. It might signal financial trouble ahead, like being unable to cover unexpected expenses or facing difficulties in retirement planning. Knowing your net worth helps you set realistic financial goals and create a plan to achieve them.

The Average Net Worth: Breaking It Down

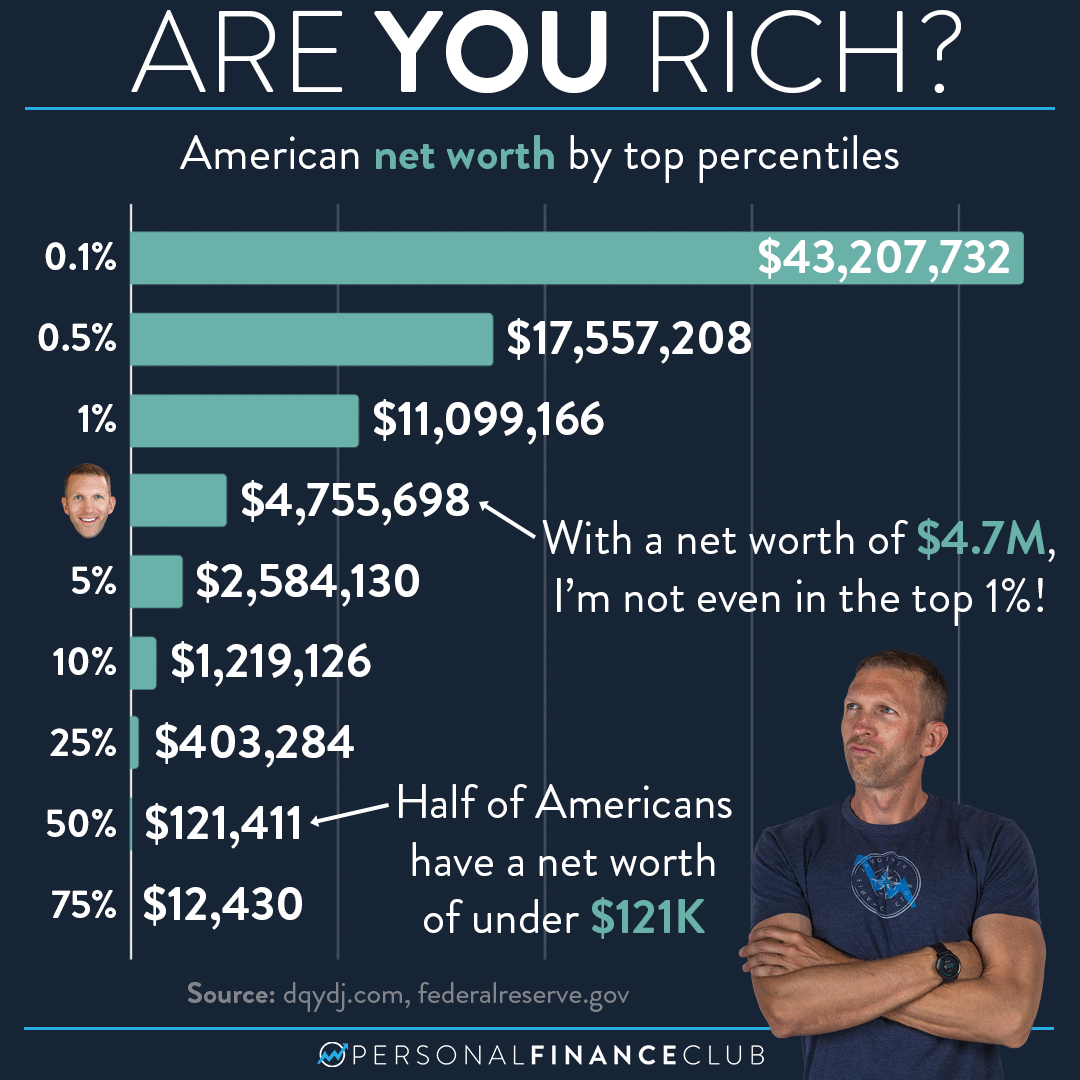

So, what’s the average net worth? Well, it depends on a bunch of factors, like age, location, and income level. According to the Federal Reserve, the median net worth of U.S. families in 2022 was around $121,700. But hold up—median and average are different things. Median means the middle value, while average is the total sum divided by the number of people. The average net worth tends to be higher because it’s skewed by the wealthy.

For example, younger people typically have lower net worths because they’re just starting out, building careers, and paying off student loans. Meanwhile, older folks who’ve been saving and investing for decades tend to have higher net worths. Location also plays a role—people in big cities might have more debt due to higher living costs, while those in rural areas might have fewer expenses but less income.

Read also:New Color Factory Nycs Immersive Art Experience 2023

Factors That Influence Common Net Worth

Let’s take a closer look at the factors that shape the common net worth. Understanding these can help you figure out where you stand and how to improve your financial situation.

- Age: Younger people generally have lower net worths because they’re still building their careers and paying off debts.

- Income: Higher income usually leads to higher net worth, but it’s not a guarantee—spending habits matter too.

- Education: People with higher education levels tend to have better job prospects and higher net worths.

- Debt: Student loans, mortgages, and credit card debt can drag down your net worth if not managed properly.

- Investments: Putting money into stocks, real estate, or retirement accounts can boost your net worth over time.

How to Calculate Your Net Worth

Calculating your net worth is simpler than you think. All you need is a pen, paper, and a bit of honesty. Start by listing all your assets—things like your house, car, savings, investments, and any other valuables. Next, jot down all your liabilities, including mortgages, loans, and credit card balances. Finally, subtract your liabilities from your assets, and voilà—you’ve got your net worth!

Here’s a quick example:

- Assets: $200,000 (house) + $30,000 (car) + $20,000 (savings) + $50,000 (investments) = $300,000

- Liabilities: $150,000 (mortgage) + $10,000 (student loan) + $5,000 (credit card debt) = $165,000

- Net Worth: $300,000 - $165,000 = $135,000

See? It’s not rocket science. Regularly calculating your net worth can help you track your financial progress and make smarter money decisions.

Common Misconceptions About Net Worth

There are a lot of myths floating around about net worth, and it’s time to set the record straight. One common misconception is that net worth is all about how much money you make. While income plays a role, it’s not the only factor. Spending habits, saving, and investing are just as important—if not more so.

Another myth is that having a negative net worth means you’re a financial failure. Not true! Many successful people started with negative net worths because they invested in education or businesses that paid off later. The key is to have a plan to turn things around.

Why Comparing Net Worth Can Be Dangerous

It’s tempting to compare your net worth to others, but that can be a slippery slope. Everyone’s financial situation is different, and what works for one person might not work for another. Plus, social media often shows only the highlights of people’s lives, making it easy to feel like you’re falling behind when you’re actually doing just fine.

Improving Your Net Worth: Tips and Strategies

Now that you know what net worth is and why it matters, let’s talk about how to improve yours. It’s not as hard as you might think. With a bit of discipline and smart financial moves, you can boost your net worth over time.

1. Pay Down Debt

Debt is like a heavy anchor dragging down your net worth. Start by tackling high-interest debts first, like credit cards. Consider the snowball method, where you pay off smaller debts first for quick wins, or the avalanche method, where you focus on debts with the highest interest rates.

2. Build an Emergency Fund

Life is unpredictable, and having an emergency fund can save you from financial disaster. Aim to save at least three to six months’ worth of living expenses. This way, if something unexpected happens, you won’t have to dip into your assets or take on more debt.

3. Invest Wisely

Investing is one of the best ways to grow your net worth over time. Consider putting money into retirement accounts like 401(k)s or IRAs, which offer tax advantages. Diversify your investments to spread risk, and don’t forget to research before jumping into anything.

4. Increase Your Income

Earning more can help you build wealth faster. Look for opportunities to advance in your career, negotiate a raise, or start a side hustle. Every extra dollar you earn can be used to pay down debt, save, or invest.

Net Worth by Age: What’s Considered Normal?

Net worth varies significantly by age, so let’s break it down:

- Under 35: Many people in this age group are just starting out, so a negative or low net worth is pretty common. Focus on building good financial habits.

- 35-44: This is the time to start seriously building wealth. Paying off student loans and saving for retirement should be top priorities.

- 45-54: By this age, your net worth should be growing steadily. Consider increasing your retirement contributions and exploring other investment opportunities.

- 55-64: This is the home stretch before retirement. Make sure your net worth is on track to support your golden years.

- 65+: At this stage, your focus should be on preserving your wealth and ensuring a comfortable retirement.

Data and Statistics: The Net Worth Reality

According to the Federal Reserve, here’s a breakdown of median net worth by age:

- Under 35: $13,900

- 35-44: $91,300

- 45-54: $168,600

- 55-64: $212,500

- 65-74: $266,400

- 75+: $264,800

These numbers give you a rough idea of where you stand compared to others in your age group. Remember, they’re just averages—your personal situation might differ.

Financial Tools to Track Your Net Worth

Tracking your net worth doesn’t have to be a hassle. There are plenty of tools and apps that can help you keep tabs on your financial health. Mint, Personal Capital, and YNAB (You Need A Budget) are just a few examples. These platforms let you connect all your accounts in one place, making it easy to see your net worth at a glance.

Final Thoughts: Take Control of Your Financial Future

Understanding your net worth is the first step toward financial independence. It’s not about having a million-dollar mansion or a luxury car—it’s about building a solid foundation for your future. Whether you’re just starting out or looking to improve your financial situation, the tips and strategies we’ve covered can help you get there.

So, what are you waiting for? Calculate your net worth today, set some goals, and start working toward a brighter financial future. And hey, don’t forget to share this article with your friends and family. Knowledge is power, and the more people who understand net worth, the better off we all are.

Table of Contents

- What Exactly is Net Worth?

- Why Does Net Worth Matter?

- The Average Net Worth: Breaking It Down

- Factors That Influence Common Net Worth

- How to Calculate Your Net Worth

- Common Misconceptions About Net Worth

- Why Comparing Net Worth Can Be Dangerous

- Improving Your Net Worth: Tips and Strategies

- Net Worth by Age: What’s Considered Normal?

- Data and Statistics: The Net Worth Reality

- Financial Tools to Track Your Net Worth

- Final Thoughts: Take Control of Your Financial Future